America’s Debt Clock Keeps Ticking Higher and Higher

It is now $36,928,542,738,461 dollars! Tick tick tick tick tick tick

And the 1,116 page Big Beautiful Bill is predicted to add trillions more to the deficit with one trillion going to the “Department of Offense” - just in time for the war profiteers in America and Europe to divert the public’s eye from their crumbling economies by igniting a real life and death war around the globe.

In 1989, when America’s national debt was heading towards three (3) trillion dollars, real estate developer Seymour Durst wanted to highlight America’s growing public debt so he created the U.S. Debt Clock, that pulls its data from the national treasury.

In July 2018, Reason Magazine stated:

In 1989, a New York businessman who was worried about chronic federal budget deficits erected the National Debt Clock in midtown Manhattan to keep a running tally of how much the U.S. government owes. The total had reached $2.7 trillion, and Seymour Durst wanted "to call attention to the soaring debt and each family's share of it."

For a long time, it kept rising. In 1998, though, the clock abruptly stopped working. "The computer couldn't take it anymore," said Douglas Durst, who had succeeded his late father as head of the Durst Organization. "The numbers were too high."

But eventually, things changed. The government began piling up budget surpluses, and the clock ran backwards. In 2000, Durst decided to retire the clock. "It's served its purpose," he said.

He was mistaken, and he soon recognized the clock was still needed. In 2002, with red ink again rising, the clock was switched back on—showing $6.1 trillion. In 2008, though, when the debt blew past the $10 trillion mark, it no longer had enough space to display it. An upgrade was done so the clock could keep up as the debt rose above $19 trillion in 2016 and above $21 trillion this year.

As seen in this chart above, during a crisis like WWII, the national debt per Gross Domestic Product (GDP) was 110% - still less than today, with the current debt ratio now over 133% of the GDP. This is unprecedented and unsustainable.

Cicero, (106 BC to 43 BC) who lived during the end days of the Roman Republic, predicted that the public debt would bankrupt the Roman republic while Rome continued to de-base its currency, continued fighting too many wars and allowed the people to become dependent on the government.

How did that work out?

As the 21st century continued, America’s welfare state expanded, with the welfare state costing American taxpayers more than one trillion dollars a year currently to keep the people dependent on the government for sustenance, along with the burden of uncontrolled immigration costing Americans more and more each year. (Well, at least that number is going down, finally.) Then add to that, the mind-numbing expense of the “Department of Offense.” (That’s an article unto itself.)

Per the U.S. Debt Clock, in 1980, America’s national debt was approximately $914 billion, and that represented a significant increase from $352 billion in 1970. In 1980, 19,074,203 people were collecting food stamps.

In 2025, with the debt now closing in at $37 trillion dollars, we have more than 43 million people collecting food stamps.

It’s simply unsustainable when there is no debt ceiling cap and unlimited credit.

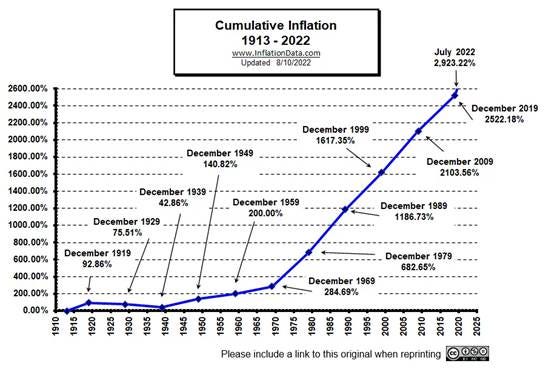

Add in the fact that since the Federal Reserve started printing more money with no intrinsic value, thus causing further inflation which creates an added tax burden on taxpayers, it hits those of us without expendable income the hardest.

The worst part is that creating this massive welfare state never ends well for anyone because dependency on the government harms the receiver in mind, body and spirit, while those of us who pay our taxes every year, barely hanging on, grow madder and madder at the parasites - individual and corporate welfare takers alike. Throughout history, this growing debt burden with increased dependency has never ended well and there is no reason to think America will be any different.

Yet, as the debt continues to grow, too many people shrug it off, thinking, America will never go bankrupt, much for the reasons Claude gives.

I asked Claude about the U.S. Debt Clock. Claude said:

The Debt Clock was created by real estate developer Seymour Durst in 1989. He installed the original clock on a building he owned near Times Square in New York City to draw public attention to the growing U.S. national debt.

Regarding its accuracy:

· The clock uses publicly available Treasury Department data to track the national debt in real-time

· It generally provides a reasonably accurate representation of the official government figures

· The clock has had to be modified several times as the debt grew beyond its original display capabilities

· In 2000, when the national debt temporarily decreased, the clock was actually turned off for a period

· It was reactivated in 2002 when the debt began rising again

The original clock was replaced with a more advanced version in 2004. The Durst Organization continues to maintain the clock, which has become an iconic reminder of the nation's fiscal situation.

The clock doesn't account for nuances in different types of debt (intragovernmental vs. public debt) or contextual factors like GDP ratios, but as a straightforward representation of the raw debt figure, it's generally considered accurate based on official Treasury data.

Is there anything specific about the Debt Clock you're curious about?

Yes, Claude. I am worried about the U.S. going bankrupt with its unsustainable and unprecedented national debt.

Claude replied:

The question of whether the U.S. will go bankrupt at its current pace of spending is complex and heavily debated among economists and policy experts. Here's a balanced perspective:

Unlike individuals or companies, the U.S. has unique characteristics that make traditional bankruptcy unlikely:

· The U.S. borrows in its own currency, which it can print

· It has the world's reserve currency status

· It maintains taxation authority over the world's largest economy

· It has historically maintained strong credit markets

However, there are legitimate concerns about fiscal sustainability:

· Growing debt-to-GDP ratio (which has increased significantly in recent decades)

· Rising interest payments consuming larger portions of the federal budget

· Long-term demographic challenges affecting Social Security and Medicare

· Political gridlock making fiscal reforms difficult

Most economists don't predict a traditional bankruptcy scenario but rather suggest other potential consequences if debt continues growing unsustainably:

· Higher borrowing costs affecting economic growth

· Reduced fiscal flexibility during future crises

· Potential inflation risks

· Gradual erosion of global economic leadership

The timeline and severity of these issues depend on numerous factors including economic growth rates, interest rates, policy changes, and global conditions.

Rather than imminent bankruptcy, the more likely scenario involves difficult policy choices about taxation, spending priorities, and entitlement reforms in the coming decades.

So, now that we are in unprecedented territory with our expanding national debt, what happens when America has a new crisis? The war profiteers are going to ignite a world war. The war drums are beating louder and louder in Ukraine, Russia, China, Iran and the Middle East every day, so all we can do is hope and pray that our President does not take the bait. But, what happens to the public debt if and when we have a “new” war?

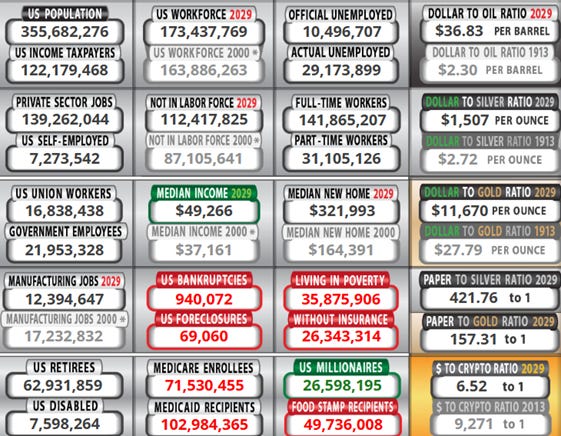

At current rates, the 2029 debt clock time machine predicts the national debt to top over 46 trillion dollars (at 140.22 % debt to GDP) with nearly 50 million people collecting food stamps.

So, what do we do? Well, the obvious solution is to stop spending money we do not have and end dependency, but there are too many deep state grifters in DC who bribe the dependent grifters with added “benefits” and that is out of our control now.

If we put the U.S. dollar back on the gold standard, that might help alleviate much of the debt with the value of gold currently, but that would appear like a magic trick and that is still out of our control.

The Stoics tell us to enjoy the moment and not to worry about what we cannot control – like the madness in DC – so we should get some sunshine, take a walk in the woods and smell the sweet aromas of spring. Saying some extra prayers certainly cannot hurt.

And on that note, have a good weekend and enjoy the moment as best as you can!

I didn't know it but I guess I'm in with the Stoics. I use to get upset and complain to everyone around me when the debt was ~19 trillion. It's almost double that now. I've learned to relax because there's nothing I say or do to change the debt trajectory. We send 536 people to Washington DC and only about three of them are focused on the debt/deficit. Now I focus on things that I enjoy and can have impact on; my family, my garden, chickens, and maintaining a healthy environment on my little piece of property here in east Texas.

The 2029 debt clock projections for gold & silver was quite revealing! $11,670 per oz. of gold, $1,507 for silver. Right now gold is $3,351 and silver is $35.60. That's only four years away.

I liked your new name for the DOD: Department of Offense. Accurate. I still prefer the original name: Department of War. It was crystal clear what it's goal is.

Considering alot of debt is held by foreign countries including China this could prove disastrous.