Every year since 1996, I have completed our federal and state income taxes by St. Patrick’s Day and if we owed more money than originally absconded, I would file on April 15th. Why wait for the inevitable when I had everything needed to file? We must pay our taxes on time or else punitive fines will be attached to our tax bill. I learned this lesson the hard way.

In 1995, while my husband and I both juggled our full-time jobs with part-time jobs for added income, while raising a pre-schooler son, the IRS put a lien on our little bank account that rarely saw a comma. [In 1994, I got my first professional job as an entry-level paralegal which pushed us into the next tax bracket.] We had to pay approximately $1,000.00 more to Uncle Sam and it felt like it might as well have been a million dollars. We barely had the funds to pay rent, day care, old car repairs, etc., so we didn’t pay that tax bill. Guess what happened?

The Feds quickly put a lien on our little bank account without a comma. Who knew? I called the IRS and made a payment plan that we eventually paid off. The IRS agent told me that it could have been a lot worse, since he deducted some fines off the total bill. Thank you, kind tax collecter.

This year I haven’t started getting all of the information in turbo tax yet. Not only do I not want to pay this year, I want my money back for all those tax dollars spent Sqaundering Our American Inheritance!

Although Senator Rand Paul’s annual Festivus Report reveals the out-of-control, insane spending by the federal government, what can we do about it? Absolutely nothing, but vote for another loser politician who enriches himself and will not do what he says he will do. If no one listens to a U.S. Senator revealing, year after year, how crazy federal government spending is, what can we do?

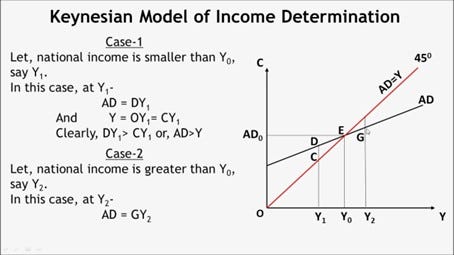

My husband and I have always employed our labor with an employer so we claimed one deduction each, and with mortgage interest deduction, two kids and later college loan interest deductions, etc., our estimated taxes usually ended up being even, so while we did not get big refunds like some did, at least we did not have to pay like some other poor sobs. And we acted like this was a win, when it was actually a lose-lose.

Ending up even on estimated tax payments ended during the 2023 tax season. I could no longer deduct the $2,500 college credit (which is a good thing since both of our two children were now self-reliant and paying their own taxes) and both my husband and I got promotions increasing our income by about 10K. But, in 2023 and 2024, we owed approximately $2,500.00 more in federal taxes, and since we did not have those funds available, and in order to avoid a penalty, we paid it on time with a credit card. So, we got a credit card fee of $60.00, added on top, along with an additional penalty since we did not pay enough for estimated taxes that our employers take out.

I emailed my senators to ask why there should be a credit card fee of $60.00 to pay federal taxes, and their staff members called and left a message for me to call them so they could tell me why they could not give me my $60.00 credit card charge back.

But, this year is different, with every daily DOGE dump, the squandered dollars feel very REAL.

I just can’t bear to write another check to Uncle Sam, and it’s not even a bank debit, but payment on a credit card that we pay interest on. I’ll rob Peter to pay Paul, until Mary offers me a 0% interest card for 18 months.

I don’t want to pay for transgender anything, let alone give another country our money through USAID for transgender something and who knows what else. The worst part is that we know this is only the beginning of the many coming scandals exposing more out-of control spending.

Plus, who doesn’t hate the time, expense and frustration of doing taxes every year?

So, why can’t we petition our U.S. President to allow us to keep our tax money this year while he continues to assist in stopping the Squandering Our American Inheritance? Is it outside of the Constitution? Yes, but so is the out-of control spending and we would be righting a ship that has gone way off course for too many generations.

Since Congress allowed the squandering of our taxpayer dollars to continue for decades and decades while they enriched themselves, their families and friends, then they should foot the collective tax bill of We the People and We the People should be exempt from paying any taxes this year!

WE THE PEOPLE, PETITION THE PRESIDENT OF THE UNITED STATES OF AMERICA TO:

Draft up one of those fancy Executive Orders that requires Congress to collectively add to their personal tax burden all of the tax burdens of every U.S. citizen who makes less than the average annual U.S. salary of approximately $76,266.00 and who do not suck off the teat of the federal government, to be exempted from filing taxes for the tax year of 2024.

Yup. I’m currently also one of those “making payments” while every year they charge me more in interest and penalties which makes the balance go up every year. It’s disgusting. If you owe a balance, that’s what you owe. Penalties and interest are a crime. I want to see the entire IRS abolished. And I’m a professional with a solid, great income. Disgusting.

I’ve been working part time for an accountant for several years. Tax season is the worst season imaginable. The things I see are really, really sad. Middle-class Americans struggling and getting hit with all these taxes. The entire system needs to be overhauled, or better yet do away with the IRS altogether. Taxes are an absolute crime. People are taxed on literally everything And it’s so completely unfair. When you see it up close and personal all day long, you really get an idea of just how messed up our tax system is. Especially for the middle class.